What is Diminished Value?

Diminished Value (a.k.a. vehicle Loss of Value) is what happens when a car is damaged in an accident and repaired. Its resale value may be less than that for a comparable vehicle that has not been damaged. Therefore, the damage, even though repaired, causes a reduction (loss) of the vehicle’s value.

How Does Diminished Value Coverage Work?

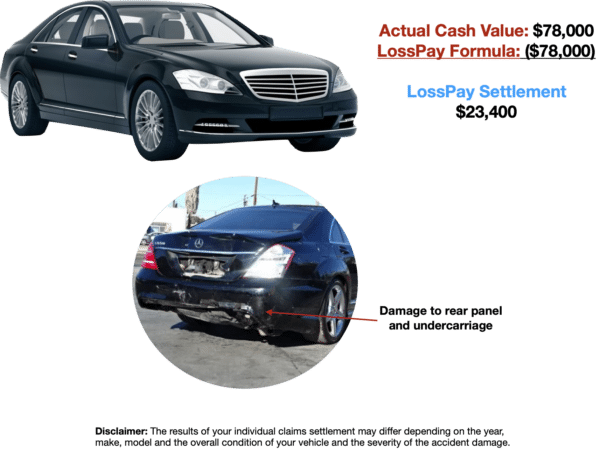

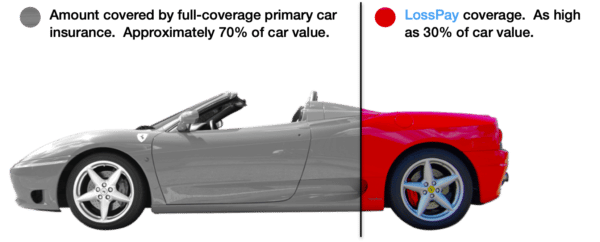

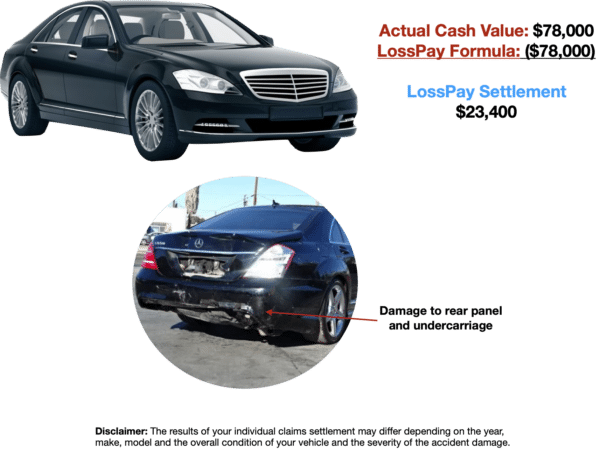

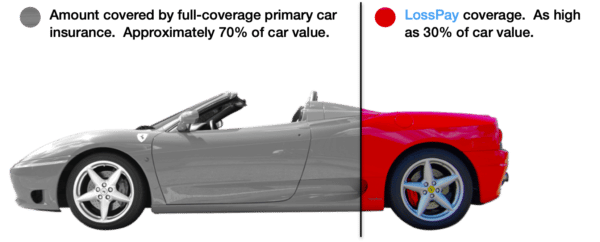

The primary function of our Diminished Value coverage is to protect car owners from suffering a financial loss. When a car is damaged in an accident and repaired the resale value becomes inherently lower. That loss in value is where our coverage begins. For Example: $78,000 vehicle is damaged and repaired, that vehicle could potentially lose $23,400 in value (approx. 30%). Our Diminished Value policy could potentially pay out $23,400 depending on the circumstances and severity of the accident.

Note: All policyholders must maintain a primary Comprehensive Full-Coverage car insurance policy during the Loss of Value policy period to qualify for coverage.

How Do You Determine My Vehicles Loss of Value?

Following an accident, claims specialist use our exclusive LossPay technology which contains a proprietary formula for calculating loss of value. It takes into consideration many factors including the severity of the damage, the vehicles pre-accident condition, age of the vehicles and mileage/KM reading at the time of accident, independent dealer analysis of market resale value along with several other key factors that help to determine a vehicles actual loss of value. See payout example below:

Have more questions? Visit our FAQ section.

What is Diminished Value?

Diminished Value (a.k.a. vehicle Loss of Value) is what happens when a car is damaged in an accident and repaired. Its resale value may be less than that for a comparable vehicle that has not been damaged. Therefore, the damage, even though repaired, causes a reduction (loss) of the vehicle’s value.

How Does Diminished Value Coverage Work?

The primary function of our Diminished Value coverage is to protect car owners from suffering a financial loss. When a car is damaged in an accident and repaired the resale value becomes inherently lower. That loss in value is where our coverage begins. For Example: $78,000 vehicle is damaged and repaired, that vehicle could potentially lose $23,400 in value (approx. 30%). Our Diminished Value policy could potentially pay out $23,400 depending on the circumstances and severity of the accident.

Note: All policyholders must maintain a primary Comprehensive Full-Coverage car insurance policy during the Diminished Value policy period to qualify for coverage.

How Do You Determine My Vehicles Loss of Value?

Following an accident, claims specialist use our exclusive LossPay technology which contains a proprietary formula for calculating loss of value. It takes into consideration many factors including the severity of the damage, the vehicles pre-accident condition, age of the vehicles and mileage/KM reading at the time of accident, independent dealer analysis of market resale value along with several other key factors that help to determine a vehicles actual loss of value. See payout example below: