Diminished Value Insurance

Diminished Value Insurance

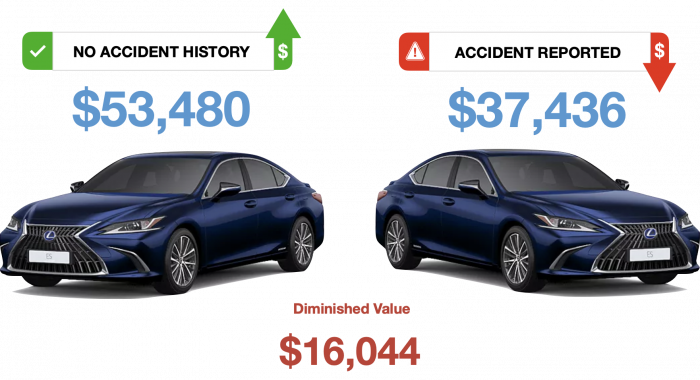

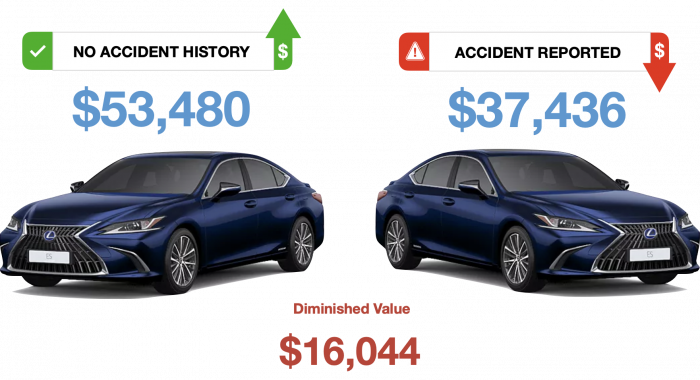

When a vehicle is damaged in an accident and repaired, its resale value may be less than that for a comparable vehicle that has not been damaged. This is called Diminished Value and is the type of coverage we provide protection against.

At LossPay, we understand the true cost of an accident goes beyond the immediate damage.

Even after repairs, your vehicle’s value can be significantly diminished, impacting your financial well-being. This hidden loss, known as diminished value, means your car’s resale value may drop simply because it has a history of damage, no matter how well it’s been fixed.

At LossPay, we specialize in helping you recover this lost value, ensuring that you receive the full compensation you deserve. Let Diminished Value Insurance restore your peace of mind by making sure that your vehicle’s worth is insured and you receive compensation post-repair that reflects your vehicle’s pre-accident value.

LossPay Diminished Value Coverage

At LossPay, we provide specialized diminished value car insurance services to help you recover the true value of your vehicle after an accident. Whether you’re a car owner, or involved in the automotive industry, our diminished value coverage is designed to meet your needs. Explore how LossPay can safeguard your vehicle’s value with our tailored services:

Why Choose LossPay Coverage

Financial Protection Against Diminished Value

After an accident, your vehicle’s value often drops, even if it’s repaired to its original condition. Traditional auto insurance typically covers repair costs but not the loss in market value. Adding LossPay ensures:

Compensation for Market Value Loss: LossPay covers the difference between your vehicle’s pre-accident and post-repair market value, protecting you from financial loss.

Diminished Value Coverage Beyond Repairs

While standard auto insurance focuses on repair costs, LossPay goes a step further by addressing the hidden financial impacts of an accident:

Beyond Standard Repairs: Traditional policies often fail to cover the financial hit from diminished value. LossPay fills this gap, providing a complete solution.

Holistic Financial Recovery: Ensures you recover not just from the physical damage but also from the financial depreciation of your vehicle.

Peace of Mind and Financial Security

With LossPay, you gain an extra layer of security that standard auto insurance might not offer:

Reduced Financial Stress: Knowing that diminished value is covered can alleviate concerns about financial losses after an accident.

Diminished Value Claims Processing

Navigating diminished value claims can be complex and time-consuming. At LossPay, we streamline the process for you with:

FAQ

You've Got Questions - We've Got Answers!

LossPay's most frequently asked questions, for additional inquiries please reach out through the contact methods below.

833-LOSSPAY

info@losspay.com

We require all policyholders maintain a primary Comprehensive Full-Coverage insurance policy to ensure the covered vehicle will be repaired in a timely manner so we can determine the most accurate loss in value. This will ultimately allow us to settle claims faster and accurately.

Note: Failure to maintain a full-coverage insurance policy will result in LossPay policy termination and/or denial of claims.

Yes. Policyholders have a 21-day (calendar days) grace period to report an accident to LossPay, Inc. If a policyholder is unable to file an accident report due to medical injuries or extended hospital stay, supporting documents may be required to settle a claim. Please see Accident Reporting procedures for more information.

Typically it takes approximately 30 days after vehicle repairs are completed to receive settlement payout.

In most cases you can enroll in a couple of minutes by answering a few straightforward questions. We may need to request additional information to fully confirm coverage and issue you with your final policy documents and declarations page, but this should take only a few days. We will provide you with a temporary binder as evidence of cover in the interim.